- Ingeniería y Servicios Aluarte

- 938 384 2000

- contacto@aluarte.com.mx

Payroll expenses: A small business guide for 2023

logo vector Codere » Free download :: Descarga gratuita » vectorlogo es

julio 26, 2023Application For Contemporary Business

agosto 2, 2023Payroll expenses: A small business guide for 2023

All new employees must submit their Form W-4 upon starting a new job. The W-4 determines how much of an employee’s paycheck will go toward taxes. Employees can ensure they’re not withholding too much or too little from their paychecks by accurately listing the appropriate allowances. These benefits can range from insurance for workers’ compensation and health protection to 401(k)s or other retirement plans with life insurance.

Withholding benefits are entirely changeable depending on your organization.

How to Record Payroll Health Insurance Premium Payments in Accounting

Payroll taxes are the amounts that your business must pay to state and federal agencies based on gross payroll figures. Employers must make contributions to employees’ Social Security and Medicare funds in the combined amount of 7.65 percent of gross wages as of 2012. In addition, most states require employers to pay industrial insurance and unemployment insurance, and the federal government requires employers to pay an unemployment insurance tax as well. Business also accrue payroll expenses in the form of employee benefits.

Another way to minimize payroll expenses is through outsourcing certain tasks instead of hiring additional staff. Outsourcing companies often provide skilled labor at a lower cost than hiring someone in-house while maintaining high-quality work. For example, statistics show that a production worker in a meat packing plant has a greater-than-average chance of suffering job-related cuts or back injuries. Because of this, worker compensation insurance rates for these employees can be as high as 15% of wages.

Secondly, the employer’s payroll taxes and obligations include social security, Medicare, and unemployment taxes. Data collection, analysis, and maintenance are necessary for businesses to manage their payroll expenses effectively. The resulting costs can vary regularly based on various factors, making ongoing monitoring and cost analysis a crucial component of any organization’s financial strategy. The cost of labor is broken into direct and indirect (overhead) costs. Direct labor costs are those expenses that are directly related to product production.

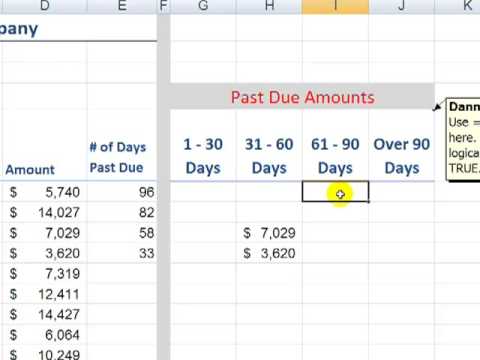

Collect information on Form W-4

The number of pay periods per year determines how much of a worker’s salary you pay on each payroll date. If you pay an employee hourly, the pay period indicates the start and end dates for payroll. To calculate your total payroll cost, you’ll need to collect information, perform calculations, pay workers, and submit withheld payments to third parties. Assume that a restaurant owes workers $3,000 in payroll for the last five days of March and that the next payroll date is April 5. Using the accrual method, the $3,000 wage expense posts on March 31, along with a $3,000 increase in wages payable. Currently, employers pay a 6.2% Social Security tax and a 1.45% Medicare tax (7.65% in total).

- Using the accrual method, the $3,000 wage expense posts on March 31, along with a $3,000 increase in wages payable.

- By automating tasks like time tracking, scheduling, and invoicing you save valuable man-hours that would otherwise add up over time.

- Employees contribute part or all of the payment for benefits through payroll deductions.

Expenses and liabilities in the payroll journal entry offset one another. The amount in the expense account is your total payroll amount for the pay period. The amount in each liability account tells you either the amount deducted from your employees’ pay or the amount you owe and to whom you must send the money.

Hourly wages are calculated as a worker’s hourly rate multiplied by the number of regular (not overtime) hours worked. Overtime for covered, nonexempt employees must be paid as mandated by federal and state laws and the Fair Labor Standards Act (FLSA). Depending on the state and the number of hours worked, this may be 1.5 or 2 times the worker’s hourly rate. To make things simple, there are four standard payroll tax forms available.

Even GCC companies need to focus on the employee value proposition in the new world of work

If you provide your employees with paid time off (PTO) or any other types of leave, that is also a payroll liability you also need to consider. Although you may not have employees taking time off every pay period, you are still liable to cover those expenses whenever they do decide to take time off. Employers are also liable for keeping track of how much time off employees accrue and ensuring that employees know how much PTO is available to them. If a state has an unemployment tax rate of 4% and an unemployment wage base of $14,000, it means that the employer’s maximum payment for each employee will be $560 per year.

With this approach, employees get their wages loaded on their card, and they can use the card to pay bills online, transfer money to family or other third parties, and make ATM withdrawals. Employee retention matters to every business because recruiting employees is a time-consuming and expensive overhead. The costs of posting jobs, interviewing candidates, confirming employment eligibility, and training new hires can quickly mount. Constantly adding and removing headcount from your payroll systems also adds an unwelcome burden on your payroll administrators and the wider HR team. This category includes all taxes that are withheld from employee paychecks, such as federal and state income taxes, Social Security, and Medicare. Read through the following questions to learn more about payroll expenses.

Legals for August, 22 2023 – Bonner County Daily Bee

Legals for August, 22 2023.

Posted: Tue, 22 Aug 2023 07:01:46 GMT [source]

Payroll expenses represent all the costs an employer incurs to compensate its workers for their labor. However, this goes well beyond regular salaries and wages, as we’ll explore in the next section. It extends to the employer-paid portion of payroll taxes, FICA taxes, unemployment insurance contributions, and more. Payroll expense is the amount of salaries and wages paid What is payroll expense to employees in exchange for services rendered by them to a business. The term may also be assumed to include the cost of all related payroll taxes, such as the employer’s matching payments for Medicare and social security. Once you’ve determined your employees’ gross wages, your share of benefit expenses, and payroll taxes, add them to get your total payroll expenses.

Payroll Expenses definition

After you subtract all deductions from your employee’s gross pay, the remaining balance is net pay. If you are running a business, understanding payroll expenses is essential for keeping your finances in order. It encompasses taxes, benefits, deductions, overtime pay, Social Security and Medicare contributions, and more.

The gross wages you pay employees may be your largest payroll expense. Wages payable is the line item that identifies how much in wages are owed to workers but have not yet been paid. When a wage expense is recorded it is a debit to the wage expenses account, which requires a credit to the wages payable account for the same amount until the wage is paid to the worker. Under the accrual method of accounting, wage expenses are recorded based on when the work was performed. In contrast, under the cash method of accounting, wage expenses are recorded at the time the payments are made. Wage expenses are sometimes reported by department and they are most likely to be reported separately for the production department.

Indirect payroll costs

Only include the amounts that your business pays to supplement these withholdings. Payroll costs are all the costs that an organization needs to pay to compensate its employees for their labor. Also included in payroll costs are employee benefits, paid time off, bonuses, commissions, the employer-paid portion of payroll taxes, and the cost of administering the payroll process. The cost of labor is the total amount of all salaries, wages, and other forms of income paid to employees. It also includes the total amounts of all employee benefits and federal, state, and local payroll taxes that your business has paid (not the portion your employees paid). This portion of your payroll expenses goes to paying hourly workers.

You must deduct federal—and possibly local and state payroll taxes—income taxes from wages. The worker’s annual income and the number of allowances they specify on their W-4 determine the amount you deduct. In a cash basis company, payroll expense is the cash paid during an accounting period for salaries and wages. In an accrual basis company, payroll expense is the amount of salaries and wages earned by employees during the period, whether or not these amounts were paid during that period. Wages are typically paid to a worker in the pay period following the period in which the work was performed, so there is always a delay, which is reflected in the wages payable account.

If you use payroll software, include the purchase or subscription costs along with costs for training your employees to use it. Unlike payroll expense, the cost of labor also includes the amounts paid to contract labor. An independent contractor (also called a freelancer) provides work for your business when needed, but they are not an employee. They are paid on a contract basis, using an IRS Form 1099 to report the payments.

By adopting best practices in managing payroll costs while optimizing procurement processes, businesses can enhance their profitability and drive growth in today’s competitive market environment. Some companies continue to provide health insurance coverage to employees after they have retired. This retiree benefit is considered to be part of the compensation package earned by employees while they are working. During the employees’ retirement years, the company’s payment for insurance will reduce the company’s liability and will reduce its cash.

If the worker is an employee, you’ll incur the cost of payroll discussed above. Independent contractors, on the other hand, are responsible for all tax withholdings. The company’s only expense is the gross amount you pay for services. For example, you may withhold amounts for the employee’s share of insurance premiums or their retirement contributions.

- Payroll costs are all the expenses involved in labor compensation and employers’ tax, administration, and other obligations.

- In contrast, payroll expense encompasses a broader range of costs related to paying employees, such as payroll taxes and benefits.

- Employees can structure their pay so that a portion automatically goes into savings, where they can access it if they need it.

- When you add the cost of the health insurance premium and PTO, the cost of these employee benefits for Sienna would be $10,923.10 per year.

- Payroll can be complicated—and to make sure it is done correctly, many companies look for professional payroll and…

- In the weeks/months of the year 2022 (when the employee is working), the employer debits Vacation Expense and credits Vacation Liability.

A wage expense is an expense account that appears on the income statement while the wages payable account is a liability account that appears on the balance sheet. All of these costs together make up the total payroll expense for a business. This expense is typically one of the largest costs for a business and is classified as an operating expense. When preparing financial statements, payroll expenses are usually reported on the income statement, which shows the company’s revenues and expenses over a specific period of time.

If you fall foul of legislation, you could face steep payroll penalty fines. This could damage your reputation in the market and the eyes of your customers and employees. Other potential payroll pitfalls include human error, negligence, fraud, natural disasters, or technology failures. Whatever the size or nature of your business, your payroll is something you have to manage carefully. Payroll can be a complex issue to understand, especially as the many rules and regulations governing it are constantly changing.